September 2024

In 2023, North America led the global market with a revenue share of $6.84 billion. This region is expected to continue holding the largest share over the forecast period. The market growth is driven by ongoing innovations in infrastructure development, financing, and consumer acceptance of drone deliveries, alongside the increase in e-commerce sales in these regions. For example, during the pandemic, consumers across North America preferred purchasing essentials like groceries and medicines online to avoid person-to-person interaction.

To meet the demand for deliveries, store owners and other ecosystem participants collaborated with local and international drone and ground delivery robot manufacturers. In January 2024, Amazon, which launched its Prime Air drone delivery service in two U.S. cities in 2022, plans to expand to three more cities, including one each in Italy, the UK, and the U.S.

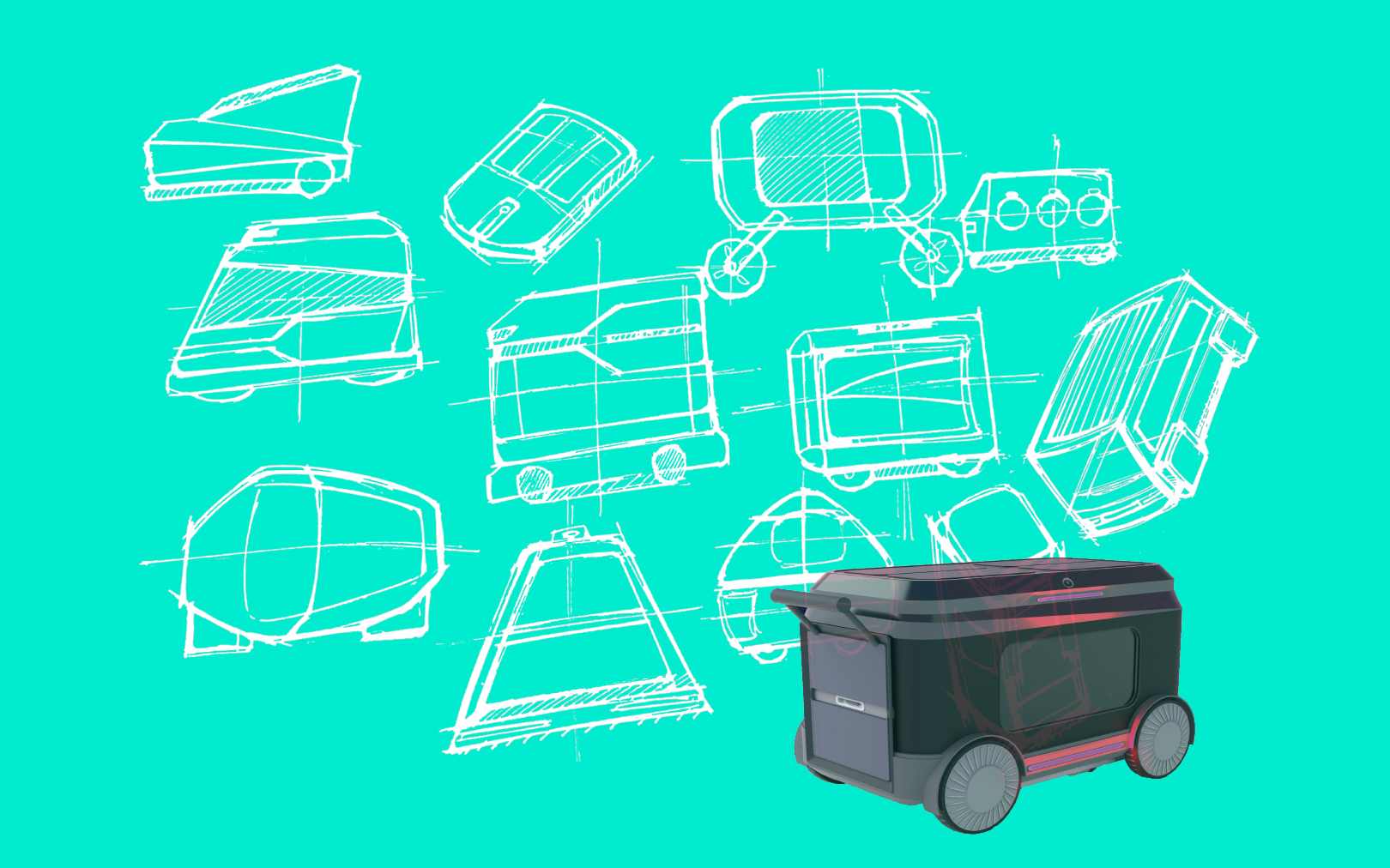

Source: Ratel SH design Studio

In Europe, major players such as Airbus, Flytrex, and Savioke, along with courier companies like Amazon, UPS, and DHL, are developing various automated last-mile delivery vehicles. These companies are collaborating with different partners to ensure the safety of fast deliveries, driving demand for automated last-mile delivery services in the European market.

In the Asia-Pacific region, leading companies like JD.com, Meituan Dianping, Nuro, and Navya are transporting medical supplies between hospital campuses. Thyssenkrupp is experimenting with using small robots to send specific components to technicians at the right place and time. These developments in the Asian courier market are expected to drive future market growth.

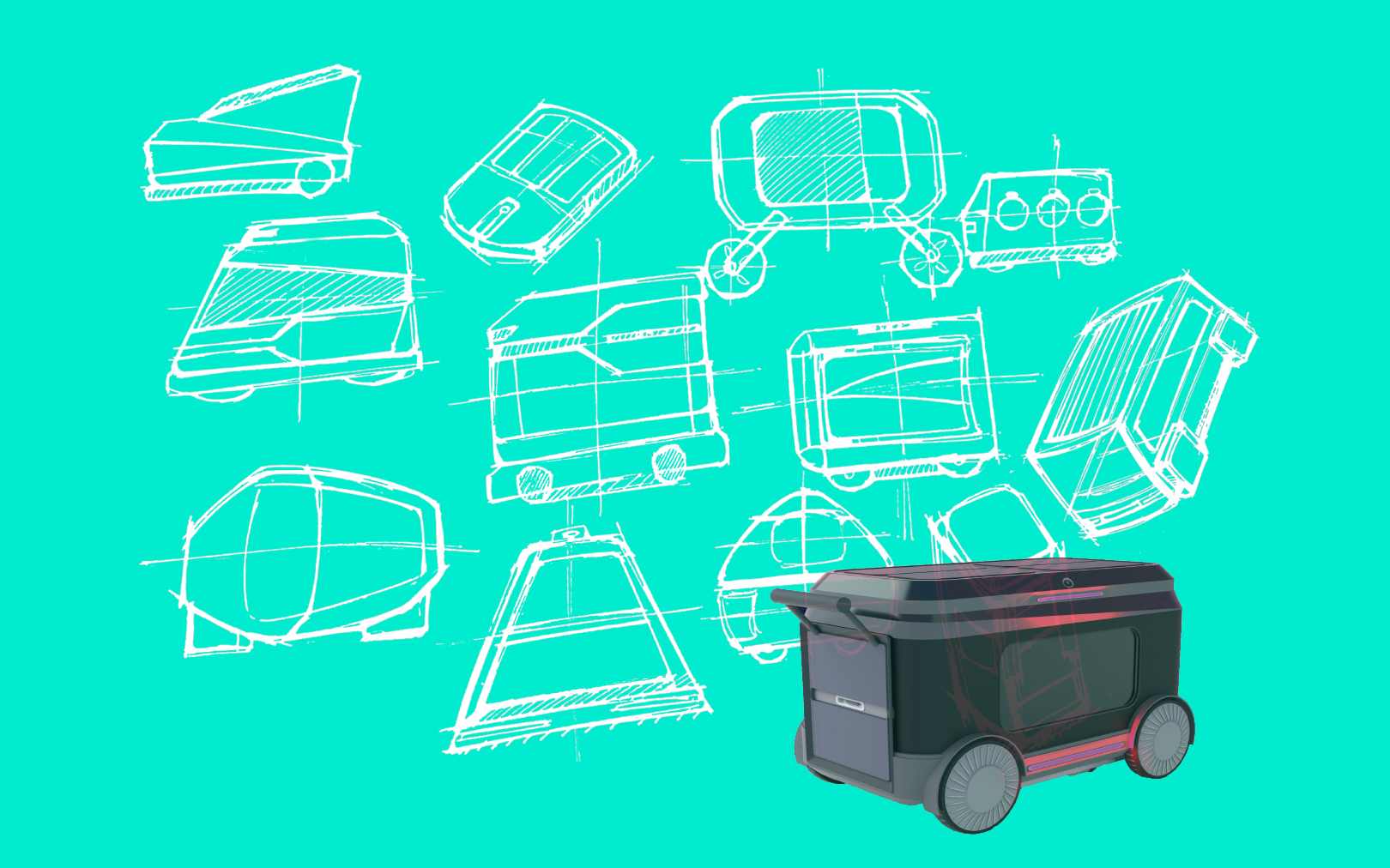

Source: Ratel SH design Studio

Source: Ratel SH design Studio

In Middle Eastern and African countries, economic development and industrial expansion present vast opportunities for the automation of last-mile delivery services. Additionally, there has been a sharp increase in the number of driverless vehicles in countries such as Saudi Arabia, South Africa, and the UAE. Demonstrations of parcel delivery by robots and changes in customers' lifestyles are expected to drive regional market growth from 2024 to 2032. According to the "2019 China Instant Delivery Market Research Report" released by iiMedia Research, China's instant delivery market had 421 million users in 2019, with 18.49 billion orders annually, or about 50 million orders per day, and a total market size exceeding 131.2 billion CNY. According to Meituan Dianping's financial report, more than 500,000 couriers are working across cities daily, with Meituan Dianping holding a 59.1% market share. Based on this, the instant delivery sector requires at least 850,000 delivery personnel daily, with each courier delivering an average of 59 orders per day. With an average monthly salary of 6,000 CNY for delivery workers, the annual labor cost in the instant delivery industry could reach 61.2 billion CNY. Market research shows that for delivery pricing, FlashEx and Dada charge 20 CNY to deliver a 5kg package over an 8km distance. Assuming delivery drones and their associated infrastructure are implemented, the pricing would likely match that of FlashEx and Dada, and with increasing drone network density, costs would decrease. In terms of speed, manual delivery can achieve 30-minute delivery within a 3km radius, while drones, avoiding traffic congestion, can deliver at 60km/h. Although delivery drones are not yet widely used and face some limitations in application, Morgan Stanley’s report on drones suggests that urban air mobility (UAM) will develop rapidly, with the international market reaching a size of $1.5 trillion by 2040.

Source: Ratel SH design Studio

Based on tracking lock technology, Ratel began developing delivery vehicles in August 2024. Currently, two models have been designed: one with four slots and another with two slots. These vehicles are developed in collaboration with Ratel's parent company, Sober D, and Meituan’s delivery robot "Noya" in China. Equipped with local AI control systems and dispatched via a 5G network from a central control room, these vehicles allow real-time control of speed and direction, making it simple and safe to return Scooters. They can even charge the Scooters while on the move.

In Richmond, Vancouver, Lime's Scooters typically undergo battery replacement between 12 AM and 5 AM. In contrast, Ratel’s intelligent delivery vehicles significantly increase scheduling density and reduce manual labor, making the rental return process more efficient and convenient.

Source: Ratel SH design Studio

Source: Ratel SH design Studio

Initially, these delivery vehicles are planned to operate on closed roads in residential communities and campuses. During this testing phase, no special permits are required.

The Ratel 4-slots Mark I has a top speed of 9 km/h, with an intelligent speed reduction mechanism that automatically slows down to 5 km/h when approaching crowds to ensure safety. It is highly efficient at high-demand locations like Skytrain stations. The vehicle can carry up to 200 kg, effortlessly transporting up to ten Scooters with dual battery systems. A full charge takes about 3-4 hours, providing a range of approximately 25 km.

Powered by an electric drive system, users can remotely reserve the vehicle through a mobile app. Future plans in Vancouver include discussions with campuses and tourist destinations like Stanley Park for potential partnerships.